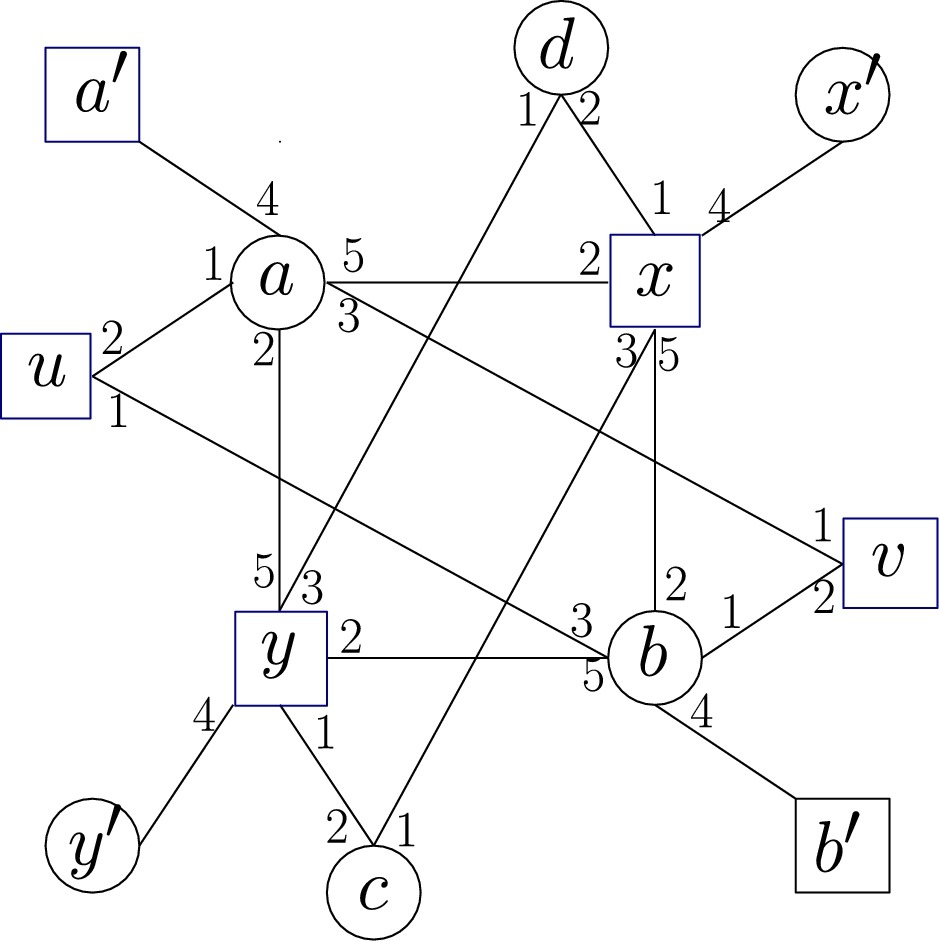

Liquidity is a key consideration in financial markets, especially in times of financial crises. For this reason, regulatory attention to and measures in this field have been on the rise for the past years. Based on practical experience, regulations aiming at ensuring funding liquidity or, in general, reducing certain risky positions have the side effect of reducing market liquidity. To understand this effect, we extend a standard general equilibrium model with transaction costs of trading, endogenous market liquidity, and the modeling of regulation. We prove that funding liquidity regulation or divesting bad ESG assets reduces market liquidity.

Publication file: https://kti.krtk.hu/wp-content/uploads/2023/03/KRTKKTIWP202307.pdf

Authors: JUDIT HEVÉR – PÉTER CSÓKA

Publication Year: 2025

Year of publication: 2023

Publication number: 2023/07

MTMT: 33844791

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.